Latest Insight

Is 'Warsh Nomination' the Ultimate Entry Point in Precious Metals?

On January 30, 2026, President Trump confirmed Kevin Warsh as his nominee to succeed Jerome Powell as Chair of the Federal Reserve.

February Opportunity Map

January 2026 has been defined by a decisive "flight to quality," as a unique convergence of geopolitical friction, specifically centered around Greenland and the Middle East, and aggressive de-dollarization headlines sent the U.S.

What’s Really Happening in Venezuela?

The U.S. has carried out its most forceful regime-change operation in Latin America in decades, culminating in the capture of Venezuelan President Nicolás Maduro.

January Opportunity Map

January kicks off 2026 with a whirlwind of economic data and central bank signals, creating a roadmap for traders seeking actionable insights.

Soft CPI Are Rate Cuts Back on the Table?

The U.S. Consumer Price Index (CPI), a key gauge of inflation that influences interest rates, investment decisions, and market sentiment, came in softer than expected in November 2025.

Silver Hits All-Time High

Silver has emerged as the top-performing commodity of 2025, climbing over 100% since January. Tight physical supply, shifting demand dynamics, and global inventory constraints have driven prices to historic highs.

2026 Markets Outlook

As 2026 forecasts begin to surface, a notable theme is emerging across Wall Street research desks: the AI-driven earnings cycle is arriving earlier and with greater force than previously modeled.

Wall Street Meets New York’s First Muslim Mayor

Markets began the day pricing in a new political narrative after Zohran Mamdani, a 34-year-old democratic socialist, secured a historic victory as New York City’s youngest and most progressive mayor in over a century.

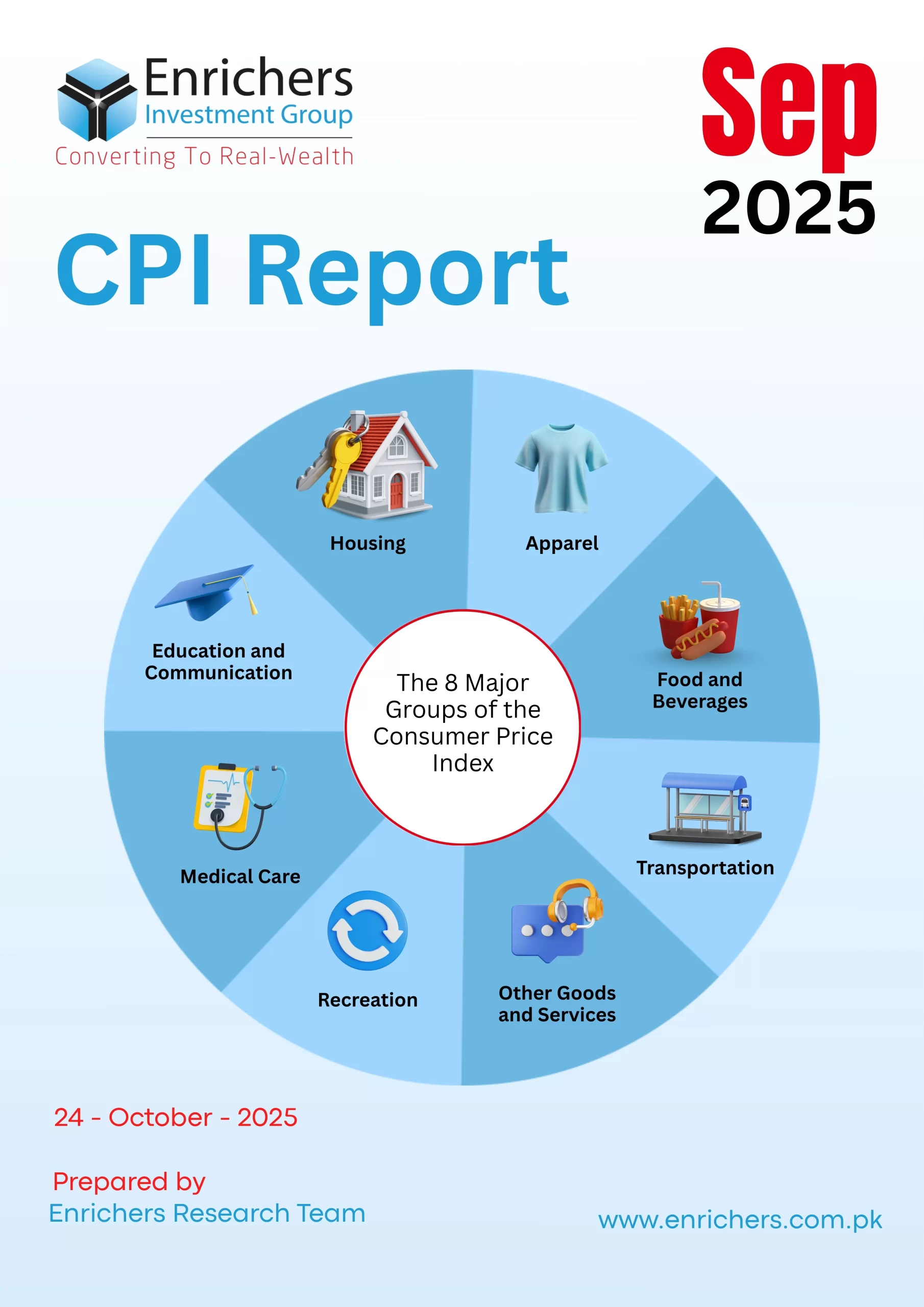

CPI Report

The U.S. Consumer Price Index (CPI) for September shows inflation cooling slightly. This release is the only official economic data amid the ongoing federal shutdown and will guide Social Security cost-of-living adjustments.

Gold Unstoppable

How High Can It Go?

Gold surged past $4,200 per ounce, setting a new record as geopolitical tensions and dovish Fed expectations drive traders' demand. Silver, platinum, and palladium followed suit, hitting fresh highs.

Washington on Pause

The U.S. government officially entered a shutdown at 12:01 a.m. ET after Congress failed to pass federal funding.

October Opportunity Map

September reminded traders why macro calendars matter: policy moves, softer labor reads, and safe-haven flows combined to produce concentrated, tradable volatility.

Precious Metals Surge on Safe-Haven Demand

Gold soared to a record $3,855/oz, propelled by a combination of rate-cut expectations, U.S. government shutdown risks, and heightened geopolitical uncertainty.

Markets Are Already in 2026-2027

Much of today’s market optimism is not rooted in next quarter’s earnings, nor even in 2025 expectations. The real driver lies further out — in 2026 and 2027 projections.

Fed Begins 2025 Easing Cycle

The Federal Reserve lowered its benchmark rate by 25bps to 4.00–4.25%, marking its first cut of 2025 and the first easing since December 2024.

AI Boom Could Push S&P 500 Beyond 7000

S&P 500 has defied skeptics for over a decade, climbing from one milestone to the next. Now, with artificial intelligence reshaping business models and traders' expectations, the question is no longer if the index will go higher; it’s how much higher.

Is Fed About to Shock the World?

This week could decide the fate of the dollar and the Fed’s next move. With inflation data around the corner, traders are asking one question:

September Opportunity Map

August’s market momentum was undeniable—record breaking highs, Fed rate-cut hopes, and a tech-driven rally dominated headlines. Yet beneath the optimism, subtle shifts in jobs, inflation, and sentiment hinted at September’s real show-stoppers ahead.

Ukraine Talks in Washington

President Zelensky returned to Washington for high-stakes talks with US and European leaders, following Trump’s meeting with Putin in Alaska.

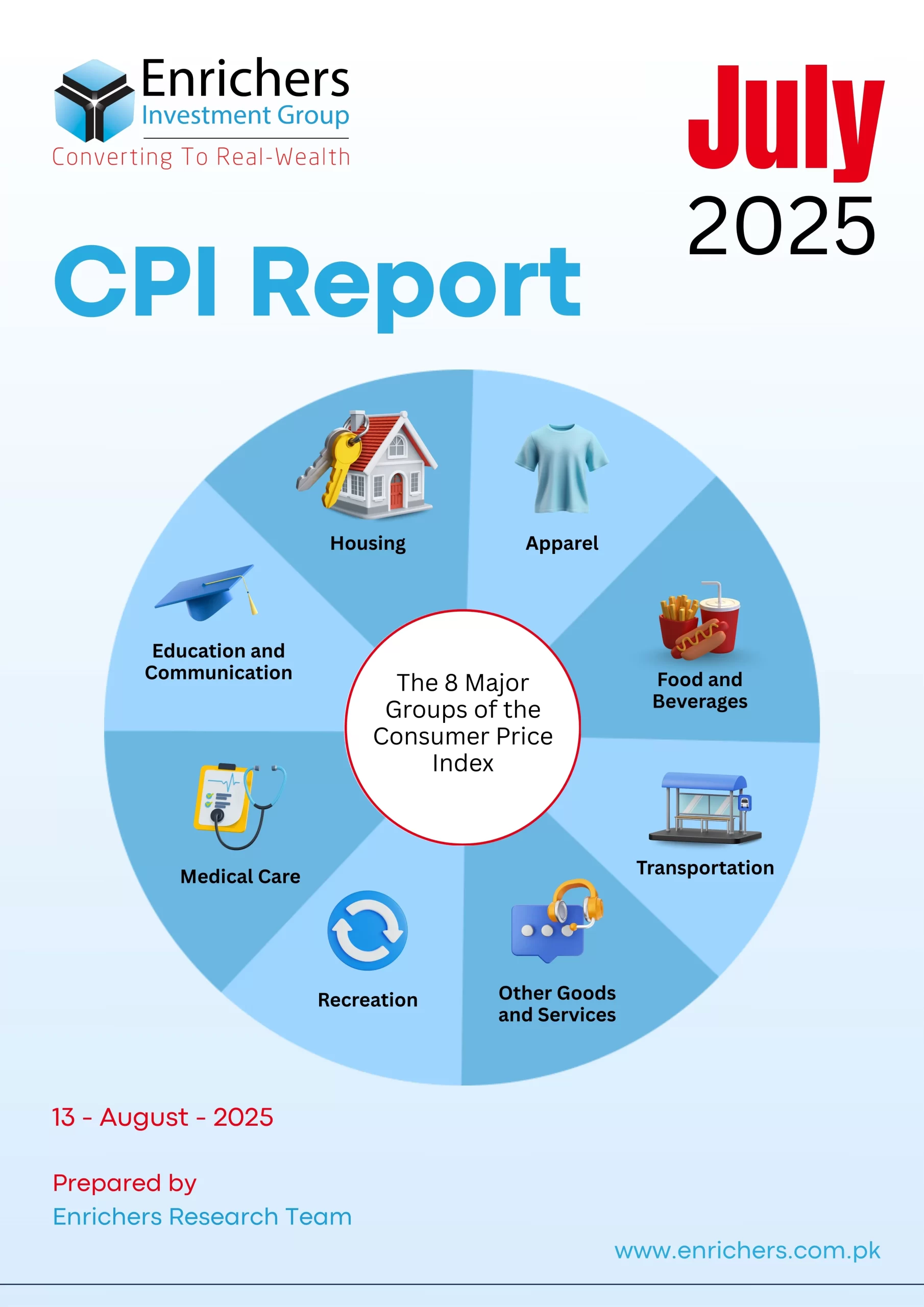

CPI Report

Inflation came in softer than expected in July, easing some tariff concerns and giving markets fresh confidence in a September Fed rate cut. Core inflation remained sticky, but the data was market-friendly.

Inflation in Focus Why This Week Matters for Traders?

Global markets ended last week on a strong note, with the S&P 500 climbing 2.5%, the Nasdaq Composite hitting a fresh record after a 4% gain, and the Dow Jones up 1.4%.

Trump Targets Russian Oil Buyers But at What Cost?

President Trump’s latest strategy to pressure Russia into ending the war in Ukraine could end up punishing the U.S. more than its intended targets.

Job Growth Slows What’s Next for the Workforce?

Every first Friday of the month, markets hold their breath for one number: Nonfarm Payrolls. It’s not just a job count, it’s a real-time pulse of the U.S. economy.

Could August Shift the Whole Year?

August is shaping up to be an important month across global financial markets, with traders watching a cocktail of macro data, central bank signals, and geopolitical undercurrents.

What Are the Magnificent 7 Stocks?

The Magnificent Seven refers to seven of the most dominant and influential tech companies in the U.S. stock market.

Wall Street Pulse Q2 Earnings

The Q2 earnings season paints a mixed but revealing picture. While revenue growth has been solid across many names, profit margins are under pressure from higher interest rates, lingering inflation, and persistent tariff costs.

Nasdaq Just Made History

The Nasdaq 100 just notched a historic technical achievement, closing above its 20-day moving average for 60 consecutive sessions, the second-longest streak since 1985.

CPI Climbs Spending Locked

The Consumer Price Index (CPI) is a widely used measure that tracks the average change in prices over time for a basket of goods and services.

Oil Prices Edge Higher Amid Sanctions Talk

Oil markets started the week on a firmer footing as traders braced for potential new sanctions on Russia, moves that could further tighten global energy supplies and send crude prices upward.

Silver & Platinum Take Center Stage

While global headlines focus on inflation, interest rates, and trade wars, two metals have quietly outperformed everything else on the chart: silver and platinum.

Busboy to Billionaire

In a groundbreaking moment for the global tech and financial landscape, Nvidia has become the first publicly traded company in history to reach a $4 trillion valuation, surpassing household giants like Microsoft, Apple, Amazon, and Google’s parent Alphabet.

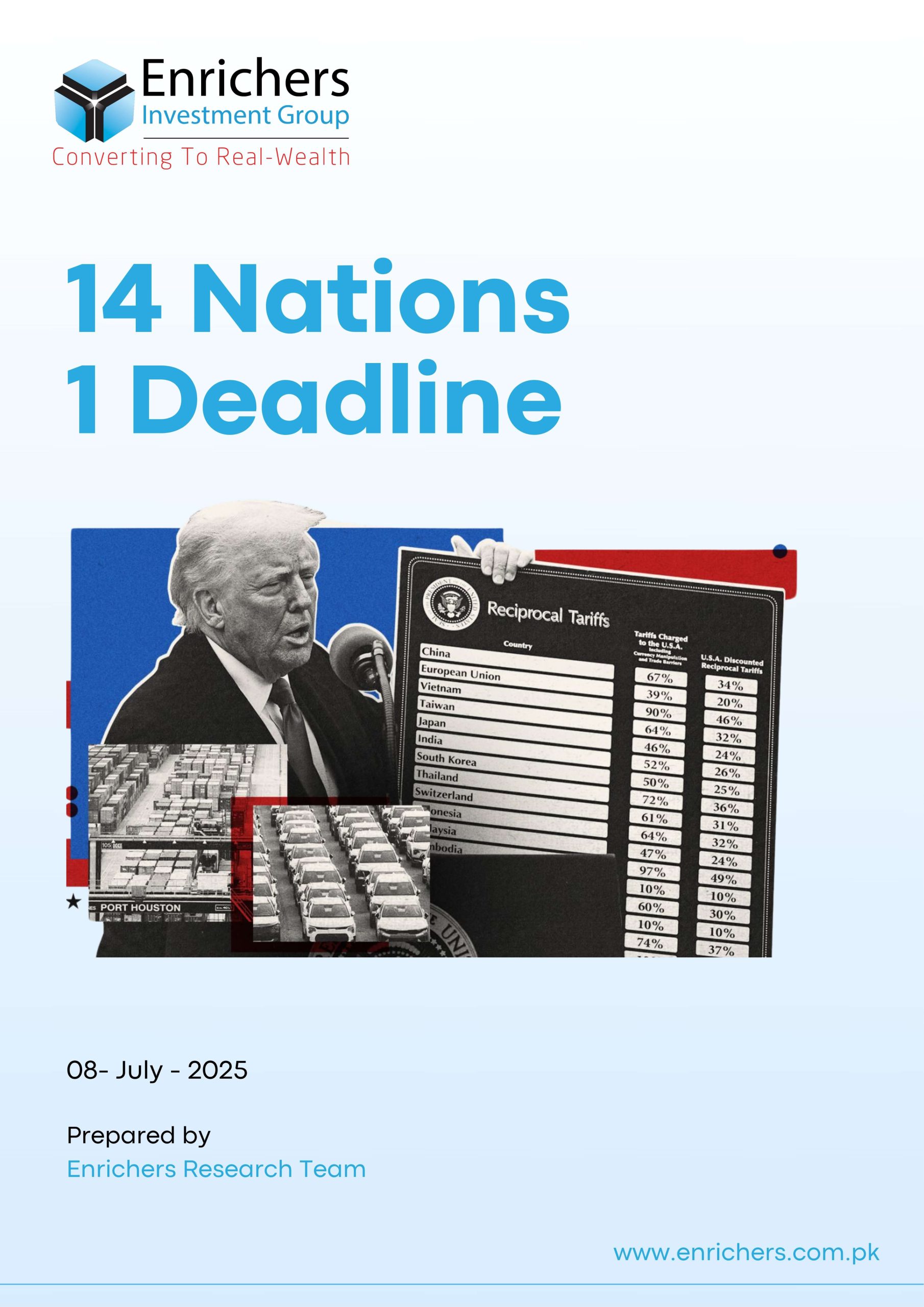

14 Nations 1 Deadline

On Monday, July 7, President Donald Trump reignited global trade anxieties with a flurry of 14 letters addressed to key US trading partners, including Japan, South Korea, South Africa, Thailand, and Malaysia.

Jobs Report Chained the July Rate Cut

The Federal Reserve is now highly unlikely to cut interest rates at its July 28–29 meeting, following a strong June jobs report that undermined recession fears and reaffirmed the strength of the U.S. labor market.

Can Pakistan Become the Next Crypto Frontier?

In a series of bold moves, Pakistan has stepped into the global crypto conversation, not as a bystander, but as a country potentially positioning itself for leadership in the blockchain era.

Will July 9 Redraw the Global Trade Map?

On July 8, a 90-day pause ends on Trump’s proposed “reciprocal tariffs”, a policy aimed at pressuring over 180 countries to accept new trade terms under the threat of steep tariff hikes starting July 9.

Wall Street’s Wild Ride into H2

US stock futures ticked higher early Monday, suggesting another record-setting day ahead for Wall Street, capping off what has been one of the most turbulent first halves in recent memory.

Decades of Pressure

The tension between Iran and Israel isn’t new, and it’s not just about politics. It goes back over 40 years and is deeply rooted in ideology, power, and regional influence.

What the Fed Drama Could Mean for Global Markets?

President Donald Trump has reignited his war of words against Federal Reserve Chair Jerome Powell, the very man he once appointed to lead the world’s most influential central bank.

Markets Shift Gears After the US Strike

President Donald Trump’s decision to directly bomb Iran’s deeply buried nuclear facilities marks a historic escalation and a deliberate break from his earlier policy of avoiding large-scale foreign entanglements.

War Clouds Over the Mideast

As the Israel–Iran air war enters its second week, both sides are trading increasingly destructive strikes, with Israeli raids targeting nuclear infrastructure and top Iranian leadership, and Iran retaliating with missiles

Oil Up Stocks Down What’s Next?

Global markets turned sharply lower amid escalating geopolitical tensions and renewed inflationary concerns, setting a risk-off tone across asset classes.

Is the U.S. Entering the War?

Global financial markets are experiencing a mix of geopolitical risk and monetary policy uncertainty.

What Is the Fed and Why Is This Meeting Important?

Global financial markets are experiencing a mix of geopolitical risk and monetary policy uncertainty.

Oil Prices: Volatility in Motion

Crude Oil Surge June 13: Brent soared 7% to $74.23, WTI up 7.3% to $72.98 — markets reacted fast to rising tensions.

Escalating Israel-Iran Conflict

On June 12, Israel launched airstrikes targeting Iranian nuclear and military facilities. In response, Iran has carried out retaliatory strikes.